CROWN PROPOSES DEMERGER TO SPIN OFF INTERNATIONAL ASSETS

Crown Resorts has announced a multi-billion-dollar break-up of its gaming empire that will see the demerger of its offshore assets. Crown will spin off its interests in Asian gaming company Melco Crown Entertainment and its partly owned offshore assets into a separate listed company called InternationalCo.

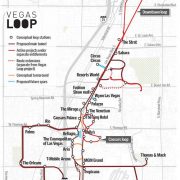

In addition to Melco, the international assets to be demerged will be Crown’s investment in the Alon development site in Las Vegas, its 20 per cent holding in restaurant chain Nobu, its 50 per cent holding in British gaming group Aspers and its investment in US gaming group Caesars.

Crown Resorts, which is 53 per cent owned by Australian billionaire James Packer, would continue to own and operate its casinos and hotels in Melbourne and Perth, as well as the hotel and casino under development at Sydney’s Barangaroo precinct. It will also hang on to Betfair Australasia, its 62 per cent stake in online bookmaker Crownbet and the 50 per cent it holds in the Hunter Valley’s Ellertson Resort.

Nasdaq-listed Melco’s profits have plunged with the struggles of the Chinese economy and the crackdown on corruption by China’s government keeping high-rollers away from Macau.

The result has been a poor return for Crown investors whose shares have nosedived more than 30 per cent since January 2014.

Crown Resorts chairman Robert Rankin said the initiative is a response to what the Crown board sees as a “material undervaluation by the market of Crown Resorts’ assets.”

“In particular, we believe that Crown Resorts’ extremely high quality Australian resorts are not being fully valued and the Crown Resorts share price has been highly correlated to the performance of its investment in Macau,” Mr Rankin said.