MATT MORAN TALKS TO AICD ABOUT HOSPITALITY RECOVERY

The date 21 March is etched on chef Matt Moran’s memory. Saturday night bookings at his two-hatted restaurant Aria, with its million-dollar views of Sydney Harbour, dropped from 200 to 70 as restaurants started shutting down due to COVID-19, diners became cautious and overseas tourists began disappearing. Moran, who owned nine venues with Solotel director Bruce Solomon, knew he was in trouble.

“We had a board meeting in mid-March and we talked about what could happen if revenues dropped 25 per cent,” says Moran. “Then someone joked that we should look at what would happen if we dropped 50 per cent. We were trying to work out what would be the scenarios. I don’t think, in that meeting, anyone thought we would lose 100 per cent of our revenue and no-one expected things would move so fast. Twelve days later, we were closed and I was in panic mode.”

Eight months later, all but one of Moran’s restaurants, Little Big House in Brisbane, which has been closed permanently, have reopened, albeit on limited trading. Opera Bar, for instance, reopened in September for 300 guests with social distancing (a far cry from the 1800 crowd pre-COVID-19). Barangaroo House, with its three levels of bar, restaurant Bea and outdoor venue Smoke, on the top floor overlooking Darling Harbour, has reopened on reduced hours.

Moran says millions have been lost in revenue yet he fears the worst is yet to come, saying Easter 2021 will be crunch time, depending on the government’s decisions on whether to continue JobKeeper and other support measures.

As for the hardest aspect of a pandemic and economic crisis, Moran doesn’t hesitate. “Not knowing what is going to happen,” he says. “Not knowing if it will come back, not knowing whether you’ll be able to employ everyone that you used to employ. I don’t know whether there’s going to be a vaccine. Or if it will go away. I think the hard time is going to be after Easter in 2021 when JobKeeper and all that might go. It’s going to be very hard for us to survive if JobKeeper goes and we’re still restricted on space.”

He says he hopes he doesn’t haven’t to close venues, but adds, “It’s a reality, yes.”

Wes Lambert MAICD, CEO of the Restaurant & Catering Industry Association of Australia (R&CA) since 2019, says Moran isn’t alone as his team grapples with establishing the new foundations of the business. Lambert predicts up to one in four restaurants won’t make it through COVID-19 and with Victoria’s lockdown and restrictions, he estimates that figure could exceed one in three in that state.

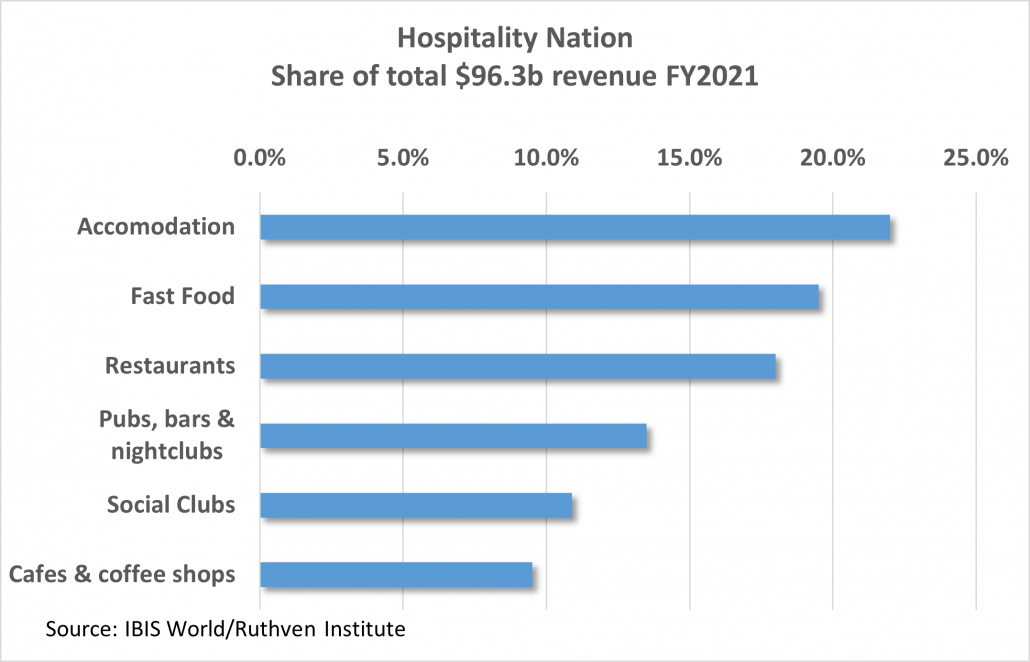

Research by IBISWorld found an estimated 441,000 Australian hospitality jobs vanished virtually overnight, with its report Failure to Lunch predicting a 25.1 per cent decline in revenue for Australian restaurants in 2019–20 and $5b wiped from the bottom line. “Restaurants and cafes have taken a hiding, but in all states they are crawling on all-fours to get back on their feet,” says IBISWorld founder Phil Ruthven.

“We don’t see our standard of living returning to near-2020 levels [before COVID-19] until 2025.”

He points to “nervousness this year” and “limited discretionary spending money in 2021–23 as a result of government overkill and a $360b debt spree” as an explanation.

R&CA, which represents 47,000 restaurants, caterers and cafes, has been calling for increased caps on numbers for weddings and business events, and a relaxation of social distancing rules to allow more people in venues.

“The downturn has certainly been quite a shock to an industry that had been growing at a reasonable rate every year since the Olympics in 2000,” says Lambert.

“As Australia remains in a sawtooth recovery of up-and-down restrictions, we hope for it to be just a drop of 25 per cent and no further during the crisis and early stages of recovery. We expect it will take two to four years for the industry to get back to its 2019 revenue levels.”

Lambert describes the challenges of 2020 as “the perfect storm” that will have ramifications for the sector well into 2021. “We’ve had industrial relations issues, then drought, then bushfires, which severely affected regional restaurants,” he says. “Then the floods and the pandemic. That is more than a typical industry association might deal with in a decade. And we’ve dealt with all of those in a year.”

Justine Baker GAICD, who works with Moran as CEO of the Solotel, says the group, with its 27 venues, including those part-owned by Moran, had to stand down almost all 1680 staff, leaving a tight team of eight. Of the 1680, 470 were salaried, one third eligible for JobKeeper and in mid-September, only half were back working.

Baker commends the federal government for implementing support measures so fast. She says managing JobKeeper required almost daily calls to the Australian Taxation Office. “The global financial crisis taught us a lot and we thought hospitality was recession-proof, but it clearly is not pandemic-proof,” says Baker. “COVID-19 has been a tragic tale for young people. Most of our staff are aged 20–30 and they are the generation hardest hit. Personally, standing down and stopping work for so many people has been the toughest aspect of COVID-19.”

Baker agrees with industry estimates that a large part of the hospitality industry will not survive, saying 25 to 40 per cent of venues nationally will fall over. She says the CBD venues are facing the most challenges and that trade has changed as so many people continue to work remotely. “It will be a very long time before the CBD occupancy rates recover,” she says, adding there are expectations things won’t be back to normal until after September 2021.

Case study: Solotel

Founded by director Bruce Solomon in 1986, Solotel runs 26 venues, eight part-owned by chef Matt Moran. Justine Baker GAICD has been with the restaurant group for 17 years and became CEO in 2017.

Most restaurants are small businesses that don’t have boards to advise them. However, at Solotel, Baker reports to two separate boards. One — including Moran, Solomon and independent adviser Michael Stibbard — oversees the venues Aria, Chiswick Woollahra and Chiswick at the Gallery, Barangaroo House, North Bondi Fish, Opera Bar, Chophouse, and Riverbar & Kitchen in Brisbane. Another board — including Bruce, his children Elliot and Anna Solomon, and independent adviser Greg Joffe — oversees the other 18 venues.

Baker says there’s value in having an independent adviser to the board to “keep debate and preparation robust” and “ensure we focus on the key strategic and risk-related issues”.

Baker adds that each board moved fast from monthly meetings to meeting virtually once or twice a week and talking by phone daily. “Everything was very fluid,” she says. “All of our interests were so aligned. We agreed to make value-based judgements around the fact we are a family business and everyone has individual needs, and make sure we had flexibility. There was no cookie-cutter approach. We didn’t know how long the shutdown would be – originally, we were expecting September.”

An early priority was sorting annual leave and entitlements for staff. Solotel is now back into regular meetings, weekly check-ins and daily decision-making.

Among the lessons learned, Baker lists:

- Bring the board into the detailed discussions early.

- Don’t make decisions in isolation.

- Get out of crisis mode and develop a strategic mindset.

South of the border

The scene is different in Victoria, of course, with government restrictions limiting dining to mostly outdoor settings (maximum 50 diners with one person per two square metres) and indoor dining resuming on 28 October but limited to 20 people and with one person per four square metres. Ben Shewry, owner of Attica, one of Australia’s highest-rated restaurants, known for its $310 degustation menu, has been doing takeaway and deliveries on his bicycle in Melbourne since March when Attica closed its dining room. Shewry has taken a philosophical approach about operating during the pandemic. “I came to Australia [from New Zealand] with nothing and this is all I have and it’s why I am determined to fight for it so hard,” he says.

Shewry says he has been working harder than ever, often clocking up 120-hour weeks. His motivation? “Just to survive to retain all of my team. I have 20 workers on visas who have nothing to fall back on if their jobs go.”

On Attica’s books are 42 full-time staff, including 25 chefs. In some ways, he says, doing takeaway has been easier. “Lockdown was actually easier than restrictions as in-dining won’t work with 20 diners — we need 60,” he says.

Shewry notes hospitality has always been “a free-spirited industry” with a diverse group of people. “We operate on slim margins, we are not run by boards, I have no major investors,” he says, adding that he has no plans to resume in-dining at Attica. “We decided not to reopen for in-dining when the restrictions eased and that’s been a wise decision.”

As for advice for other operators, Shewry says, “Just keep going. Those that get through will be stronger for it in the future.” Asked what support he would like from government policies, he says, “We never get asked that question about what policies we need. With so many jobs going, anyone with a job should be grateful for it.”

Small business lifeline

In the biggest changes to bankruptcy law in decades, Treasurer Josh Frydenberg announced in September that business owners with liabilities of less than $1m, such as many restaurants and cafes, will continue to control the business while a restructuring plan is developed — a debtor in possession model — as opposed to an external administrator taking over.

The measure, supported by R&CA, will come into effect, if passed by federal parliament, on 1 January, when millions of employers and their workers are due to lose the JobKeeper subsidy.

‘‘By enabling owners to remain in control, businesses will be more open to enter into the insolvency process sooner, providing them with an opportunity to restructure and increasing their chances of surviving the COVID crisis,’’ says Frydenberg. “This… process is in contrast to the current regime where owners effectively lose control of their business, with an administrator being placed in control and determining any restructuring plan to be put to creditors.’’

Under the policy, a small business operator facing financial distress can seek advice from an insolvency practitioner on developing a restructuring. The operator, working with the adviser, will have 20 days to develop the plan, which would include restructuring debt and preparing a case for creditors to consider.

Creditors will then have 15 days to vote on the plan, during which time the business can continue to trade, but must lodge any outstanding tax returns and pay out any employee entitlements. If half of the creditors accept the plan, it is approved and all unsecured creditors are bound by it. The business can then continue to trade under what will be known as a ‘‘debtor in possession model’’, meaning it can keep trading under the control of its owners.

Frydenberg says thousands of companies have fended off insolvency or liquidation under a temporary regime announced in March and extended until 31 December. The government claims a 46 per cent fall in the number of companies that went into administration from March to July compared to last year.

Reshaping the sector

Lambert says there’s been a shift in spending habits towards home delivery nationally, with 8.7 million Australians now having a delivery app on their phones, compared with four million pre-COVID-19, according to R&CA figures. He says smart restaurateurs switched to takeaway and delivery fast — and the smarter ones remain committed to it. Pre-COVID-19, takeaway accounted for eight per cent of restaurant and cafe business, and Lambert estimates it will settle at 25–30 per cent. “Customers will demand it and businesses are embracing these diverse revenue channels.”

The hospitality sector is deeply connected to international tourism and the impact of closed borders. The Australian Bureau of Statistics reports that inbound international tourism brings $60b to the economy and Lambert says 30 cents of every international tourism dollar is spent on accommodation and food services. “The expectation is that international travel will not return until the middle of 2021 on any large scale,” he says. “Everyone who comes to Australia has to eat at least three meals a day — and those meals are all provided by a business that’s in accommodation or food service. These restrictions cut deep. That’s $18b over the year, which is $1.5b in losses a month.”

However, Lambert says the pandemic has also revealed pre-existing flaws within the industry that have exacerbated the current crisis. “COVID-19 exposed many weaknesses in the industry that had been talked about, but not fully exposed — such as industrial relations issues, high rents and a shortage of local staff.

“We’re working closely with the government on things like the Restaurant Award, and ultimately the property values that will reset rents. CBD restaurants will remain depressed as long as international companies and large domestic companies keep their CBD buildings closed or severely understaffed,” he adds.

Lambert predicts a future where delivery and takeaway become a much larger part of dining, as well as bespoke experiences. “Restaurants have been so innovative already and will continue to have to think outside the box.”

Suburban revival

CBD cafes and restaurants may be eerily quiet, but trade in some suburbs has been strong as people work from their home offices.

In Sydney’s Naremburn, Rob Forsyth owns Forsyth Coffee and Tea. He says business (all takeaway) increased by 50 per cent in March and April and continues to run 30 per cent higher than pre-COVID.

“So many people are working at home around here. They are buying their coffees in the suburbs rather than near their offices,” says Forsyth. “When schools were closed, parents were coming in for milkshakes for their children as well. It certainly is a boom time.”

In NSW, overall cafe spending was 18 per cent higher than the pre-crisis norm in the week of August 17–23, according to a spending tracker developed by Accenture-owned analytics firm AlphaBeta, and credit bureau illion. In suburbs such as North Sydney, Mosman and those in the Blue Mountains, per capita spending in cafes has increased by more than 90 per cent while spending in the city’s east and west increased by more than 50 per cent, according to the data.

Regions outside Sydney have also seen significant increases, with the Wollondilly local government area to the west of Campbelltown recording the biggest increase in the state — 103 per cent — between November and July. However, the growth is inconsistent, with cafe spending in some suburbs going backwards, including a 28 per cent decline in Rockdale and a seven per cent decline in the Inner West.

In Melbourne, the report found people were still frequenting local cafes, with wealthier areas such as Bayside showing a 40 per cent increase in cafe spending. But coffee consumption almost halved in a Monash local government area devoid of students, and along St Kilda Road, home to large offices, spending dropped 25 per cent.

“People are on Zoom call after Zoom call and are desperate to get out and have a coffee, just as they would be if they were in the office,” says AlphaBeta director Andrew Charlton.

He says cafes in business districts and areas near the airport have experienced some of the biggest losses.

Case Study: Tech as a way out

Stevan Premutico was on a sabbatical, walking the 800km Camino de Santiago between France and Spain in 2017 when he came up with the new venture he says is transforming the hospitality sector. His me&u app is a mobile technology that allows diners to order and pay from their tables, by using their phones to click on a device at the tables called “Billy the beacon”, which brings up a digital menu and takes orders, reorders and manages payments.

More than 500 venues are using me&u, including the Merivale, Solotel and Rockpool groups, which run some of Australia’s premium restaurants. Venues pay 2.5 per cent per transaction and customer buying habit data is passed back to the venues.

Premutico, who founded Australia’s first restaurant reservation app Dimmi, says the speed of the growth with me&u demonstrates a shift in thinking among restaurant owners.

“At Dimmi, it took us 10 years to get a lot of the big groups and brands on board,” he says. “With me&u, that has happened within the first two years, which demonstrates there is a new appetite in the industry to use tech to improve profitability, sustainability and elevate the customer experience.”

Premutico says cash is passed back to the venue within 48 hours. He says the platform is bringing increased average spends of 15 to 38 per cent, partly because a digital menu design prompts upselling along the lines of the McDonald’s “Do you want fries with that?” approach. For example, when you order a salad, you’re asked if you would like to add some salmon, and a suggestion for a wine that goes best with that meal.

“What we’re finding is that customers are also ordering more rounds simply because they aren’t wasting time standing in a queue,” says Premutico. “It’s just easier at the click of a button.”

With wage costs a burden across the industry, Premutico says me&u is not about saving on labour, but about redefining what staff do and using tech to manage “the lower-value stuff”, such as taking orders, managing reorders and bill payment. Customer adoption in venues has skyrocketed, he says, with about 90 per cent of orders in some venues placed using me&u.

“That’s demonstrated that customers are looking for touchless experiences where they don’t have to touch the menu, don’t have to touch cash and don’t have to stand in a congested queue,” he says. “The stupid thing in the hospitality industry is that we print out a menu and assume every customer who walks into the restaurant is the same, even if you’re vegan or fat-free or nut-free or a gin drinker.

“What Netflix has done is say: here are the genres and programs you love and some others you may like. We’re doing the same with what you can order.”

Advisory board

Premutico founded Dimmi in 2008 as the global financial crisis arrived. Dimmi is similar to OpenTable in the US and the UK’s Top Table, which paved the way as they launched first.

Me&u is a new concept – one of the first of its kind in the world – and Premutico is relying on an advisory board and some big-name funders, including board members Will Easton, managing director of Facebook Australia and New Zealand; Cliff Rosenberg MAICD, former MD of LinkedIn and a director of Nearmap and TechnologyOne; John Szangolies, founder and former CEO of the Urban Purveyor Group; Robbie Cooke MAICD, CEO of Tyro Payments and former MD of Tatts Group and Wotif; Jason Pellegrino, ex-Google Australia New Zealand MD and now CEO of Domain; and chef Neil Perry. As for capital raising, in December 2019, Merivale’s Justin Hemmes and Tyro Payments threw their weight behind me&u, leading an $8m Series B funding round.

Premutico says it’s too early to confirm me&u being sold overseas, but hasn’t ruled it out. He maintains the company, which employs 30 people, is yet to make a profit. “One of the biggest challenges with me&u is that you’re at the frontline and nobody’s truly solved this problem before, so everything you do is true innovation,” he says. “I’ve tried to bring together the right expertise and capital to grow this business.”

A complication for hospitality is that the industry is “a cash-heavy business”, he says. “One of the things I’m proud of is that we’re helping make this industry cashless. With this, a lot of fraudulent stuff going on will diminish, simply because it will be an industry without cash.”

COVID-19 impact

Premutico, who worked in marketing at Hilton Hotels in the UK for five years and left to launch Dimmi, predicts one in four venues nationally — and up to one in three in Victoria — won’t reopen following COVID-19. “This crisis is real, it’s deep and it’s going to cut through this industry unlike anything else,” he says. “Pre-COVID-19, we had wage scandals and the industry was on its knees and struggling to survive. COVID-19 has knocked a big fat bullet through the industry.

“We can’t just reopen the doors. We’ve got to use this moment to rethink, reset and reinspire the way this industry operates. I truly believe the one saviour there is – which can hopefully help create a more robust, more profitable, more sustainable industry – has got to be technology.”

Boom in the bush

The shift in consumption has hit the nation’s regions differently.

Orange, in Central West NSW, for example, is experiencing a boom. Jeremy Norris, director of Byng Street Local Store, says in May his business had its best month in nine years.

In March and April, business had dropped 35 per cent, but doubled in May and the growth has continued.

“With the borders closed, people have been coming here for a break from Sydney and Canberra,” he says. “COVID-19 has meant reinventing the wheel and putting your head down.”

The cafe closed to in-dining until June and some staff were stood down while business boomed through takeaway coffees and meals. In October, Norris was due to open a new cafe called The Base, and continues to run a coffee cart at Orange Hospital and the Bloom Cafe at Bloomfield Medical Centre.

Peter Robson, chair of the tourism body Orange360 — representing restaurants, wineries, hotels and tourism offerings in the Orange, Blayney and Cabonne council areas — says that since June, tourism has never been busier. This follows an 18 per cent increase in visitors to Orange in FY 2018–19.

Robson, who owns Ross Hill Wines, says spending has nearly doubled at the winery since June, and staff numbers have increased by more than 30 per cent, partly to manage COVID-19 regulations and partly due to increased demand. He says while the first couple of months of COVID-19 were “a disaster” for regions such as Orange, things have improved since June as people from Sydney and Canberra escaped for a break to the region, unable to travel interstate due to border closures.

Regional Australia Institute chief economist Dr Kim Houghton says JobKeeper has been a lifeline for regional areas with economies based on heavily-impacted sectors such as tourism, hospitality and transport. It has kept money flowing into and around communities. “Winding it back incrementally and giving regional businesses more time to adapt is greatly appreciated – and vital for the survival of some,” says Houghton.

In WA, Karratha Mayor Peter Long reports visitor numbers doubled in July-August as WA residents travelled within their state. Mick Tucker, Mayor of Break O’Day Council in Tasmania, has reported a similar increase in tourism numbers. While 85 per cent of visitors to Tasmania are usually from NSW, Victoria and Queensland, the boom was from Tasmanians holidaying within their state.

However, Robson warns of job losses and possible business closures in the regions once JobKeeper payments decrease and the Queensland and Victorian borders open, increasing competition for the tourism dollar. He says 6000 people in Orange are employed in the tourism sector.