FIVE STEPS TO ADD BUSINESS INTELLIGENCE TO YOUR MARKETING SEGMENTATION

We all know business intelligence will improve your marketing efforts. It can identify and focus on higher profit players, increase the accuracy of your forecasting, and measure the effect of your marketing programs. But how do you identify the higher profit players.

Your best players might not be the ones with the biggest play, but rather those that play well and consistently. This includes those players that could become your best players. It makes sense to rank your players based on their value with you.

So where to start?

Below are some basic guidelines. Implementing even one of these – if you are not currently using all of them – will make a difference in your marketing programs. As you add a new strategy, make sure you are running test and control, and measuring what is working best for your player database.

Player Lifecycle:

The message should align with where the player is in their lifecycle. You want to segment your marketing programs to meet the player where they are in their lifecycle with you so that your campaign and messaging are meaningful. Treat players in their first three trips like they are new, learning about your brand and venue, and building loyalty. Talk to your loyal players like you have a relationship with them and know them. A player who is declining in play needs a different program and message including a change in reinvestment.

RFML (Recency, Frequency, Monetary, Location):

On top of the lifecycle and reinvestment, make sure you are including these key indicators to best segment your players:

Recency – When was the last time the customer was in your venue? Last 30 days, last 1-3 months, last 3-6 months, etc. Moreover, to add another great layer, is this on par with their average trips, or are they inclining or declining in trips?

Frequency –how often does a customer play? Look at the averages within your database and identify how your trips groups. i.e. 25% = 1-2 trips/month; 25% = 2-4 trips/month; 25% = 4-8 trips/month; 25% 8+

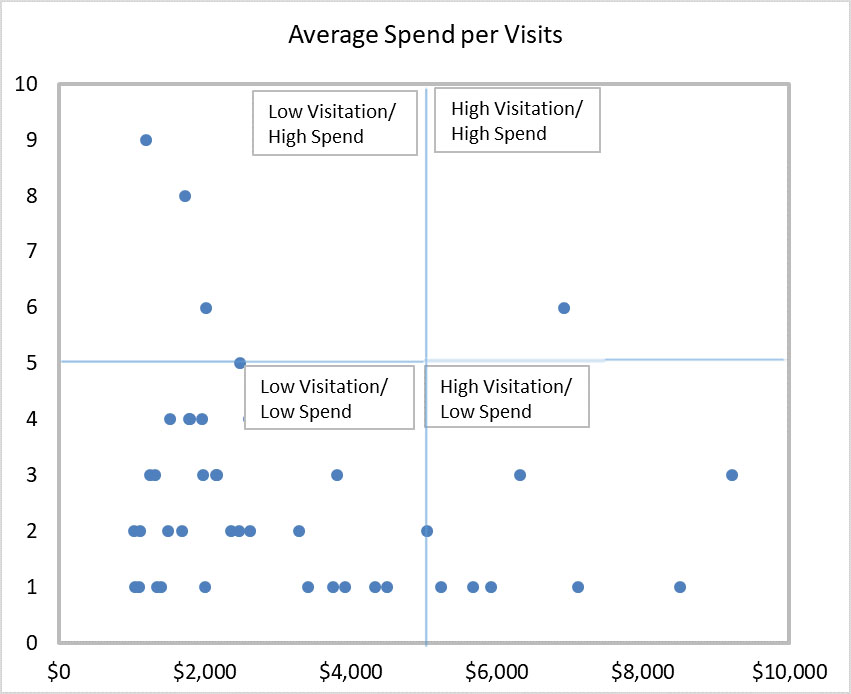

Monetary – What is their average spend in your casino? The best calculation would be to look at average daily turnover if looking at a lower frequency customer, and average monthly turnover if looking at a higher frequent customer. This goes to my point above, that a good player that is consistent with a higher frequency can be better than a big spender that comes 1-2 times a month.

Location – Is the customer local, regional or national. This can impact the offer tempo and the offer strategy.

By Lynette O’Connell