IT’S OFFICIAL: AUSTRALIA IS AN EXPERIENCE ECONOMY

Recent research has found that Australians are spending far more on experiences, outpacing spending on either discretionary or basic needs consumption.

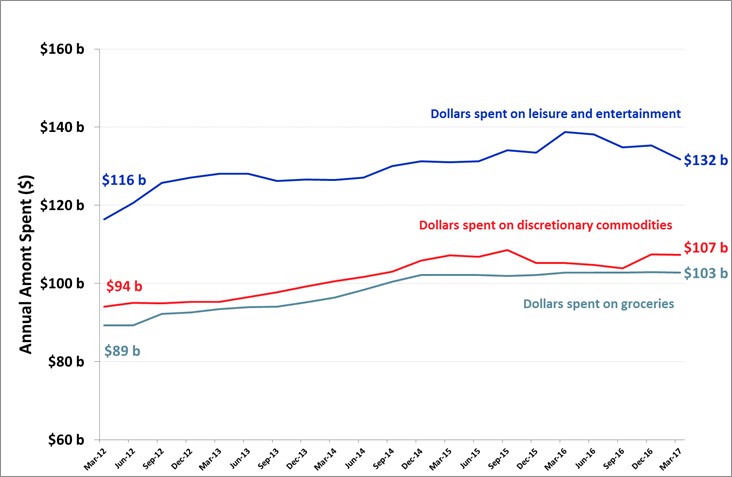

Over $132 billion was spent on leisure and entertainment in the year to March 2017 – an increase of $16 billion pa over the five years since March 2012, and far more than was spent on either discretionary commodities ($107b) or groceries ($103b) according to the latest figures from Roy Morgan (28 July 2017).

That has to be good news for the club, pub and casino industries. Right? Well maybe. It all depends on the product you are delivering as researchers also believe the spend is being driven by NEO (New Economic Order)* instead of traditional consumers.

NEO Vs TRADITIONAL CONSUMERS

Neo consumers are described as “super consumers”. They are a powerful group of spenders who make up one-quarter of the Australian population but represent half of all discretionary spending.

After more than five years of research, Ross Honeywill and Verity Byth of the Centre for Customer Strategy, pinpoint two distinct social types in Australia: Neo-consumers and Traditionals.

Neo-consumers aspire to own things that are better than they have now. They are spenders, not savers, and are comfortable with buying luxury goods. They like to purchase on impulse and, for them, style is more important than price. Cynical of big business, media and governments, Neo-consumers believe in the power of the individual and insist on making connections that are relevant and intensely personal.

The Neo-consumer prefers to eat out, will fly more often and buy twice as many books as their Traditional counterpart. Traditionals prefer large-scale shopping malls and are always on the lookout for a good bargain.

Traditionals and Neo-consumers perceive brands in completely different ways. To a Traditional, a brand is a short-cut to certainty and confidence. A Neo-consumer, by contrast, delves behind the brand to understand its origins and authenticity. Neo-consumers are changing the face of business and understanding the forces that drive a Neo-consumers can give a valuable window into the needs and wants of the high-margin, discretionary goods consumer.

Spending on leisure and entertainment exceeds spending on discretionary commodities

Source: Roy Morgan Single Source (Australia), April 2010 – March 2017. Average annual interviewing n=50,000.

Desire Economy leads the way on leisure and experience spending

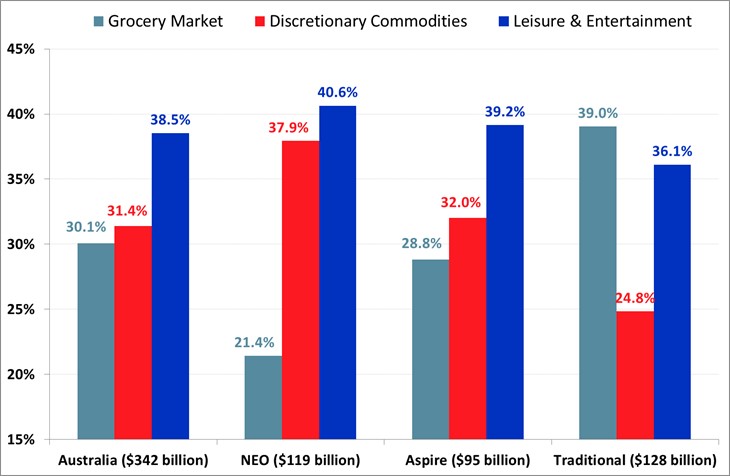

These trends are even more evident when analysing the different types of consumers in an Australian market with expenditure of over $342b in the past year on leisure & entertainment, discretionary commodities or groceries.

Australia’s 4.5 million NEOs (New Economic Order), who fuel the $600b Desire Economy, spent $119b on these three categories and their spending skewed heavily towards leisure and entertainment – $48b (40.2%) – than either discretionary commodities ($45b) or groceries ($25b).

In stark contrast, the spending patterns of Traditional consumers skew heavily towards grocery spending – $50b (39.0%) – although once again spending on leisure & entertainment ($46b) far exceeds spending on discretionary commodities ($32b).

The Desire Economy: Spending on Grocery, Discretionary Commodities and Leisure & Entertainment

Source: Roy Morgan Single Source (Australia), April 2016 – March 2017 (n=50,002).

Michele Levine, CEO, Roy Morgan Research, says the spending on ‘experiences’ is led by NEOs* who are at the cutting edge of changing consumer habits:

“Over the past year, Australians spent over $132b on experiences – dining out, going to sporting events, concerts, exhibitions, the cinema, entertaining at home and the like representing an increasingly important part of Australian spending patterns.

“Spending on leisure and entertainment clearly exceeded spending on either discretionary commodities of $107b or groceries of $103b and these spending patterns are seen most prominently in Desire economy consumers who spent nearly twice as much on leisure and entertainment ($48b) than on groceries ($25b).

“Even though the ‘frictionless’ world we are moving into will see spending on experiences becoming an increasingly important part of every individuals spending patterns, it is worth keeping in mind that Traditional consumers still comprise a significant part of the overall market – spending almost as much on groceries ($52b) as both NEO* consumers ($25b) and Aspire consumers ($27b) combined.”

Source: https://www.roymorgan.com/findings/7291-retail-spending-australia-march-2017-201707271829

NEO Vs TRADITIONAL CONSUMERS

Neo consumers are described as “super consumers”. They are a powerful group of spenders who make up one-quarter of the Australian population but represent half of all discretionary spending.

After more than five years of research, Ross Honeywill and Verity Byth of the Centre for Customer Strategy, pinpoint two distinct social types in Australia: Neo-consumers and Traditionals.

Neo-consumers aspire to own things that are better than they have now. They are spenders, not savers, and are comfortable with buying luxury goods. They like to purchase on impulse and, for them, style is more important than price. Cynical of big business, media and governments, Neo-consumers believe in the power of the individual and insist on making connections that are relevant and intensely personal.

The Neo-consumer prefers to eat out, will fly more often and buy twice as many books as their Traditional counterpart. Traditionals prefer large-scale shopping malls and are always on the lookout for a good bargain.

Traditionals and Neo-consumers perceive brands in completely different ways. To a Traditional, a brand is a short-cut to certainty and confidence. A Neo-consumer, by contrast, delves behind the brand to understand its origins and authenticity. Neo-consumers are changing the face of business and understanding the forces that drive a Neo-consumers can give a valuable window into the needs and wants of the high-margin, discretionary goods consumer.