NSW LGA GAMING DATA – ARE YOU A PRODUCT OF YOUR ENVIRONMENT?

Liquor & Gaming NSW has issued its latest gaming machine data updates as part of the NSW Government’s commitment to transparency on gambling activity in local communities. There have been many venues that have closed over the last year, and an overall reduction in machine numbers. While clubs have seen a continued decline, hotels continue with positive increases compared to last year. The difference between clubs and hotels is still significant but some trends are emerging in LGA data that suggest it’s not just purely an economic shift.

Compared to the same six-month period in 2018:

- The number of gaming machines in operation fell by 506 in clubs and by 42 in hotels – an overall fall of 548.

- The number of club gaming venues fell by 16, and the number of hotel gaming venues fell by 74.

- Net profit fell by 0.03 per cent for clubs and rose by 6.2 per cent for hotels.

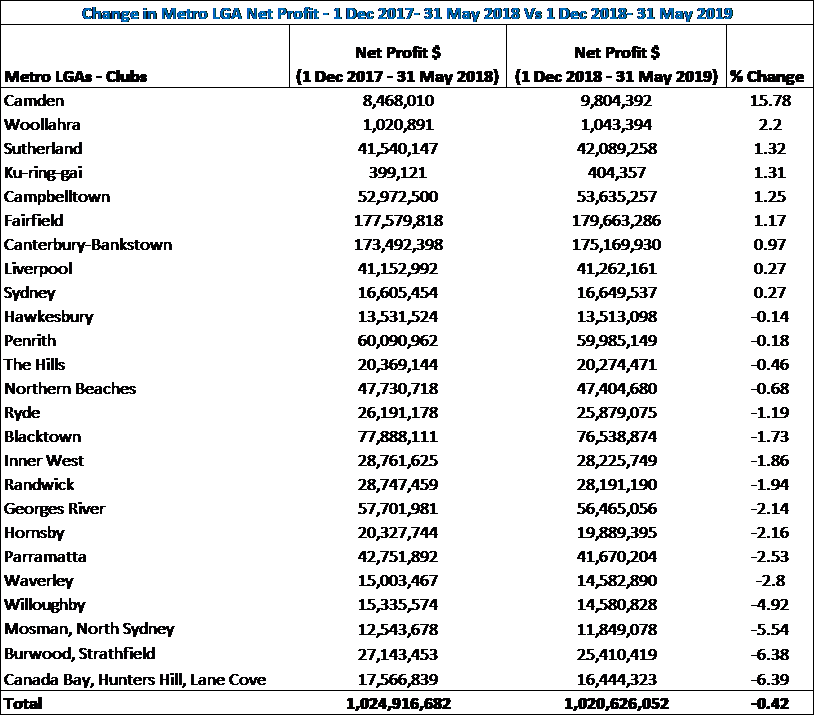

Metro LGAs (CLUBS) – early 2018 Vs early 2019 comparison

One interesting trend of this year’s data compared to the same period last year, was the change within some LGAs across Sydney Metro:

- Burwood, Strathfield, Canada Bay, Hunters Hill and Lane Cove are areas where several clubs are historically considered strong gaming venues due to the local ethnic populations. However, with the rise in house prices, and a demographic shift, these areas have seen declines since the same period last year in net profit

- Willoughby, Mosman and North Sydney, also affluent with high mortgages, high school fees and low disposable incomes has also seen clubs in those regions negatively impacted.

- Areas that ring the city such as Camden, Sutherland, Ku-ring-gai, and Campbelltown, with an increase in population, have all benefited and clubs in those areas are seeing good increases compared to last year.#The number of EGM in Metro LGA remained the same as last year (29,908 for 2018 and 29,914 for 2019), yet the net profit declined by -0.42%. Without a large increase in the Camden LGA the overall Metro decline would have been -0.55%

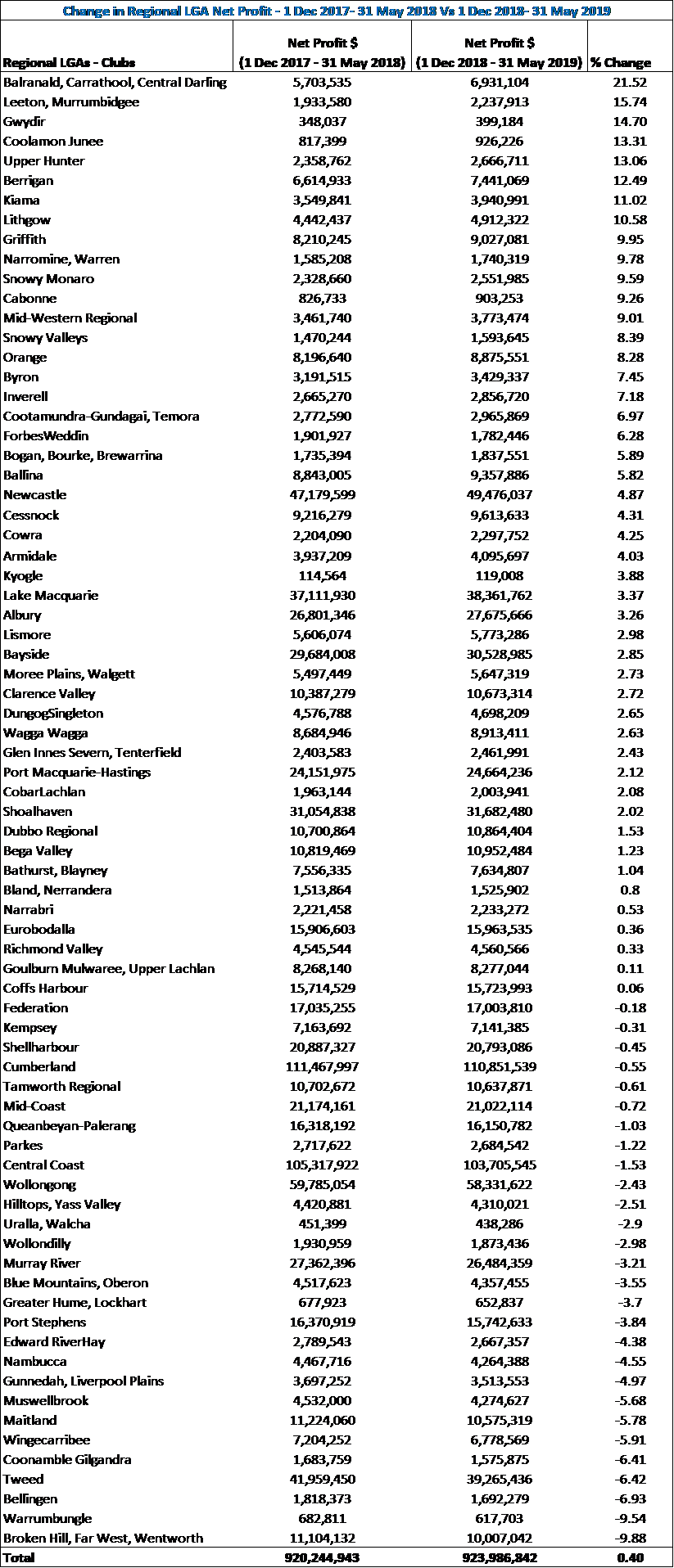

Regional LGAs (CLUBS) – early 2018 Vs early 2019 comparison

Many regional LGAs are seeing difficult times due to the ongoing drought, however, there has been a small increase in Net profit across regional NSW:

- While several of the worst hit areas are drought effected, such as Broken Hill, Warrumbungle, Coonamble etc, many country LGAs are improved on the same period last year with a 0.4% increase overall.

- Many coastal LGAs (Tweed, Nambucca, Port Stephens, Wollongong, Central Coast, Mid North Coast) are seeing large declines compared to last year

- Country LGAs still earn only a small fraction of the net profit that coastal clubs do but they are seeing improvements since last year

HOTELS

Metro LGAs (HOTELS) – early 2018 Vs early 2019 comparison

Metro Hotels increased by 5.13% across Greater Sydney with an extra 164 machines coming from hotels that have shut down over the year. Some LGA areas were reorganised since last year but the patterns of change appear similar to clubs with some areas declining due to a changing demographic.

- Over the last 12 months only 3 hotels have closed in Sydney Metro but 77 have closed in regional areas.

- In the Burwood Strathfield, Canada Bay, Hunters Hill Lane Cove LGA, where clubs are seeing significant declines, hotels in those areas are seeing the opposite shift as they upgrade, renovate.

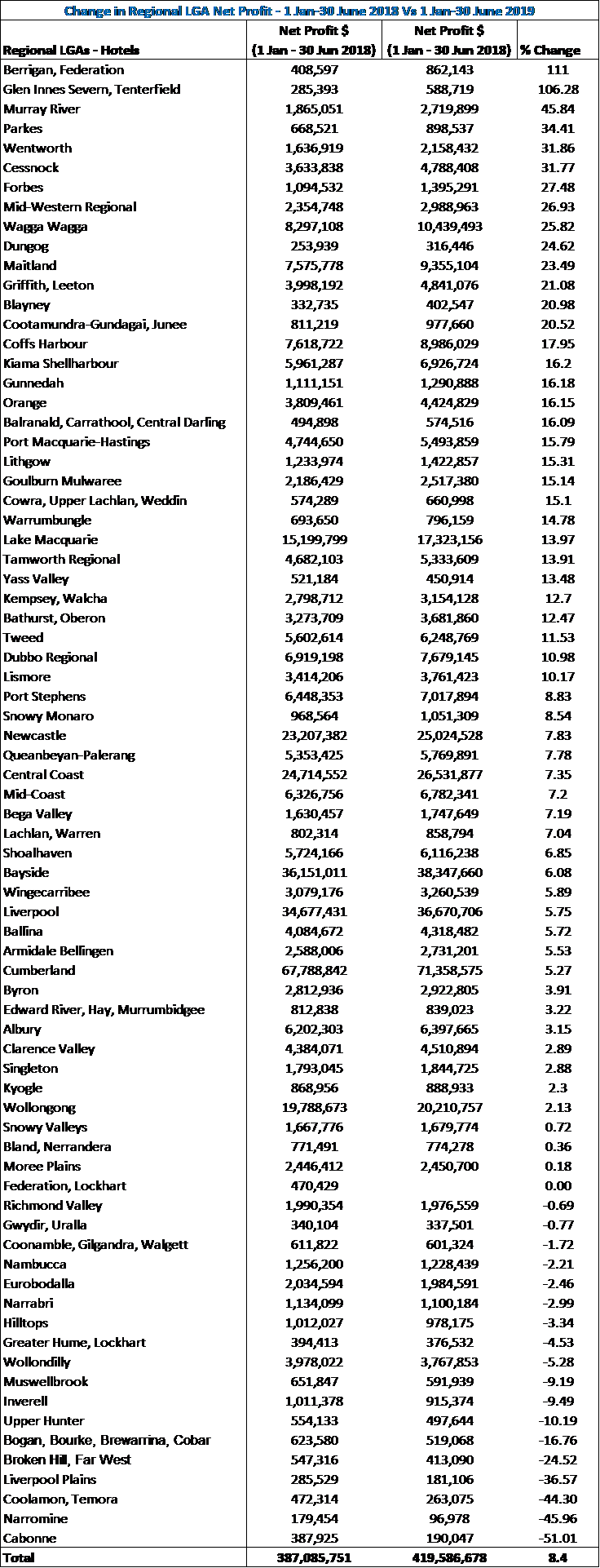

Regional LGAs (HOTELS) – early 2018 Vs early 2019 comparison

Regional Hotels increased by 8.40% in Net profit across NSW however, many of the more extreme results are due to a change in the makeup of several of the LGA boundaries in the data. Even so, there has been a further increase in the net profit for regional hotels. Many are becoming targets for large hotel groups investing in and improving the pubs. While 74 regional hotels shut down over the last year they had few machines left in them. Overall the number of machines in regional areas increased by 286 machines

- The most negatively impacted regional hotels are in drought effected areas.

- Many of the regional hotels that saw significant improvement are in areas that saw the largest decline in club profits, (Murray River, Parkes, Maitland)

The hotels are still seeing significant improvement in gaming net across NSW but appear to be lifting in many areas where clubs are declining, suggesting there is more than just economic issues creating the different results. Hotels are still investing heavily in renovations and improvements, as are many clubs, but with a smaller footprint they can keep the costs of building work down. It is possible that the branding of many hotels now and their shift to different and wider markets has made them “cooler” and more appealing than many clubs. Smaller rooms make pubs feel cosier and it is easier to meet higher service standards with less staff in their smaller hotel venues.

Article developed by The Drop from data sourced from Liquor & Gaming NSW: https://www.liquorandgaming.nsw.gov.au/news-and-media/latest-nsw-gaming-machine-data-released3