MARKETERS WILL FAVOUR FACEBOOK OVER INSTAGRAM FOR SOME TIME

Instagram’s Sluggish Story Ad Uptake and Influencer Clutter Will Drag

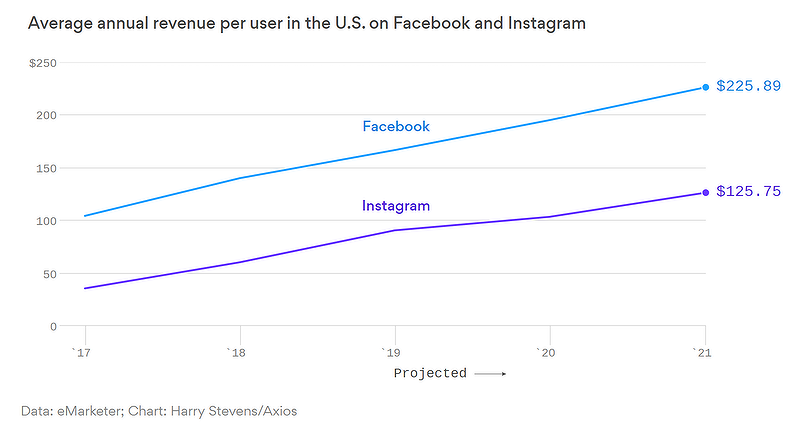

Despite Instagram’s impressive recent marketing growth, eMarketer’s latest data forecasts that it will be some time before the popular photo app catches Big Blue.

eMarketer’s estimate, reported by Axios, forecasts that Facebook will generate about $226 per user in the U.S. in 2021. Analysts expect Instagram to bring in $126 per user comparatively.

In fact, eMarketer expects the monetisation gap between the stablemates will grow further in the next few years.

Despite declining Facebook usage and increasing Insta usage.

Instagram’s rapid pivot towards Stories and Facebook’s improving solutions around Marketplace and Facebook Watch are cited as material.

Why Does Average Revenue Per User Matter?

The acronym ARPU stands for Average Revenue Per User.

This metric is used by businesses to measure the factors that are contributing to the organisation’s overall revenue. ARPU helps companies analyse their growth patterns and compare their success to competitors.

From a marketer’s perspective, when comparing channel investments, it provides a handy quantitative gauge of the probable marketing effectiveness of a channel.

ARPU is often indicative of:

- Effectiveness and quality of marketing solutions available in channel

- Trust and faith from marketers

- Scale and engagement level of the user base

- Commercial intent of the user base

- ‘Quality’ of the attention available in channel

- Sometimes the average net worth of the user base

Who Has The Highest Marketing ARPU Of All?

Amazon has the highest ARPU of all, last year ringing in the tills for $752 per customer, on average, for its global 310 million customers.

However, from a marketers perspective, this matters little since barely a whisper comes from its rapidly developing marketing solutions.

Viewed purely from a marketing perspective, all roads lead to Google.

Google’s global advertising machine is the most sophisticated and profitable in the world. Its ARPU is sky-high at $256 per user in the US and $137 globally.

Facebook last year peaked at $112 per user in the US and $25 globally.

For the likes of Facebook, Google, Twitter, etc. ARPUs vary between regions. Platforms seldom break out their stats by individual countries, breaking out by region instead.

On this basis, North America dominates, followed by EU and then APAC.

However, given how small AU/NZ populations are, and how expensive social ads are locally, one can only imagine the local markets are viewed fondly from Silicon Valley.

Australia is apparently the most expensive market in the world for Facebook ads, and New Zealand is not cheap either.

How Will Facebook Continue To Dominate Instagram?

One of the biggest takeaways from eMarketer’s outlook is that it expects the pace of growth at Instagram to slow over the next two years compared to the last two years.

Facebook CFO Dave Wehner recently flagged that Insta has reached ad load saturation for the Instagram feed.

In turn, perhaps acting as a catalyst for the recent launch of Instagram Explore ads which reduce pressure to stuff more ads into the main Feed.

A unique problem for Instagram, also, is the deluge of influencers spruiking tea, teeth whitening, bikinis, albino-single-origin-chicken-manure-which-can-reduce-the-five-signs-of-aging and other dross in organic feed placements.

It may be to counter this that Instagram is launching Creator profiles, before one day limiting and regulating their commercial posts so as not to destroy the user experience.

Also, not helping Instagram is the debatable appetite from marketers for Instagram Story ads.

Facebook’s Ad Load Woes & Solutions

Facebook claimed to reached ad load saturation on Big Blue in 2017.

While it has worked to launch new options since then, uptake outside of the mobile News Feed is limited by marketers.

Still, it saw a considerable increase in average price per ad impression since, due to an increase in demand from marketers, following the contraction of organic reach. Likewise, its growing video ad emphasis has seen more TV spend shifting across.

Facebook proper has a few sources of decent advertising real estate that it’s nurturing, which should come good within the next 24 months.

Even before considering soon to launch features like Facebook Search ads, and solutions related to Groups and Messenger lurking in the background.

Facebook launched Watch, its video platform, about two years ago. Growth started slowly, but it now has 140 million daily active viewers averaging 26 minutes of video per day. That’s nearly double from where it started the year.

Facebook is also starting to monetise Marketplace and is “seeing positive early results,” according to COO Sheryl Sandberg.

Although Instagram may be the darling for users, it appears that the so-called ‘digital gangster, destroying democracy’ will remain the marketer’s favourite for some time yet.

Source: https://smk.co/article/marketers-will-favour-facebook-over-instagram-for-some-time